You want to use the DATEV export to make your bookkeeping easier? Great, you can use this guide on where and how to store the DATEV accounts for your orderbird MINI.

Get your tax advisor on board

We recommend that you discuss with your tax advisor and/or accounting department which account numbers are the right ones for your business. It is helpful for them if they also understand how the DATEV export is structured. You can find this information here: How is the DATEV export of orderbird structured? (Info for tax advisors).

DATEV - Important to know

- All changes to DATEV account numbers are effective immediately. For a clean analysis of your turnover, it can make sense to make the changes only after the end of the day at the end of the month. It is best to discuss this with your tax advisor.

- If you leave DATEV accounts empty, accounts from the SKR 03 are automatically set. You can find out which accounts these are here: Why do account numbers that I have not entered appear in my DATEV export?

- If you do not enter any accounts, no DATEV export will be created.

DATEV Step by Step

2. Set DATEV transit account, tip account, and cost centers

3. Setting DATEV accounts for payment types on MY orderbird

4. Add DATEV account numbers for folders and items

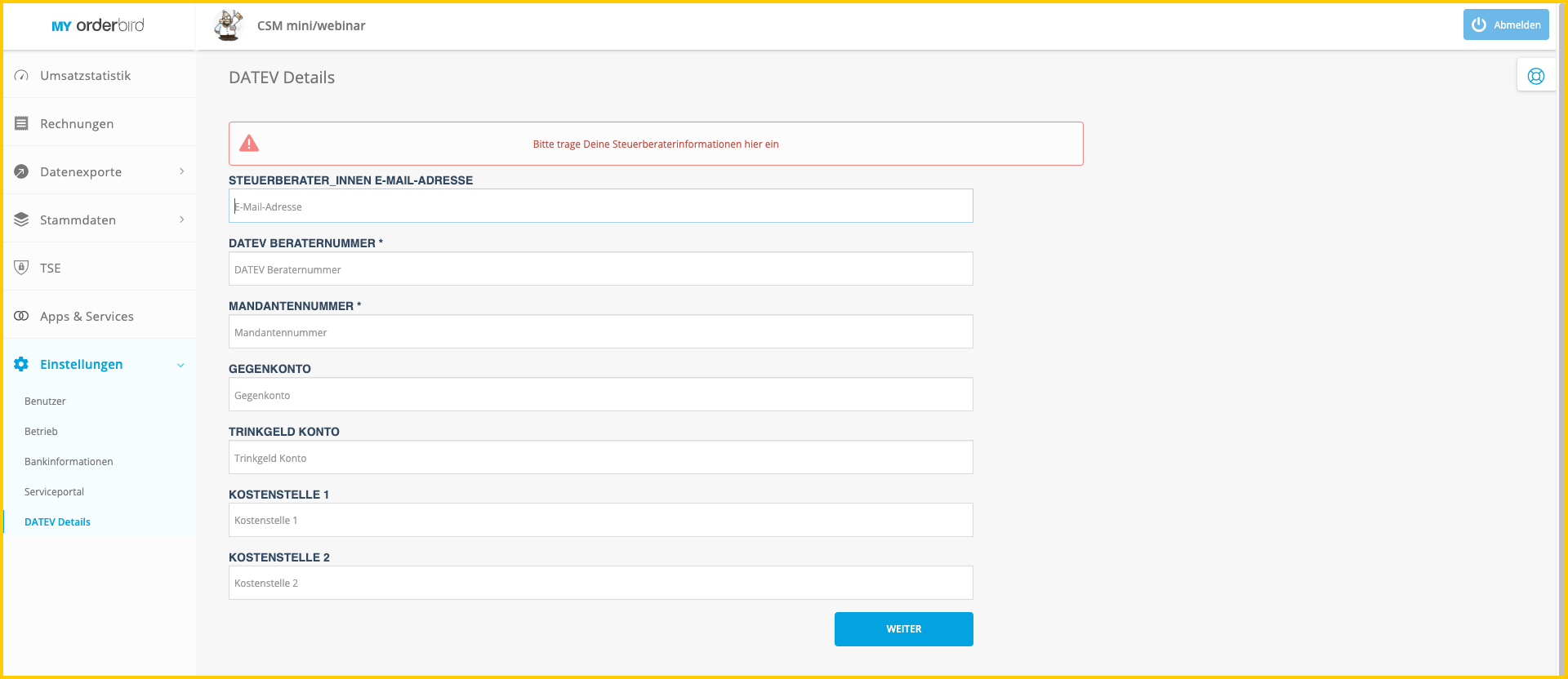

1. DATEV Details

To make sure that your DATEV does not get mixed up, we recommend that you fill in the following information:

- Log in to MY orderbird and go to Settings > DATEV Details.

- CONSULTANT E-MAIL ADDRESS: E-mail address of your tax advisor.

- CONSULTANT NUMBER: ID of your tax consultant, which is passed on to the DATEV export, so that your DATEV export always ends up on the right desk.

- CLIENT NUMBER: Your client number at your tax consultancy, which is also included in the DATEV export. So that it is immediately clear whose DATEV export this is.