Edit invoice form

Übersicht

Your customers prefer to transfer the invoice amount and ask you for an invoice with details of your bank details? No problem - on MY orderbird you can (also retrospectively!) change the information that is displayed on your invoices. For example, adjust the recipient data or enter the service period, the payment term, your bank details or your e-mail address on the invoice.

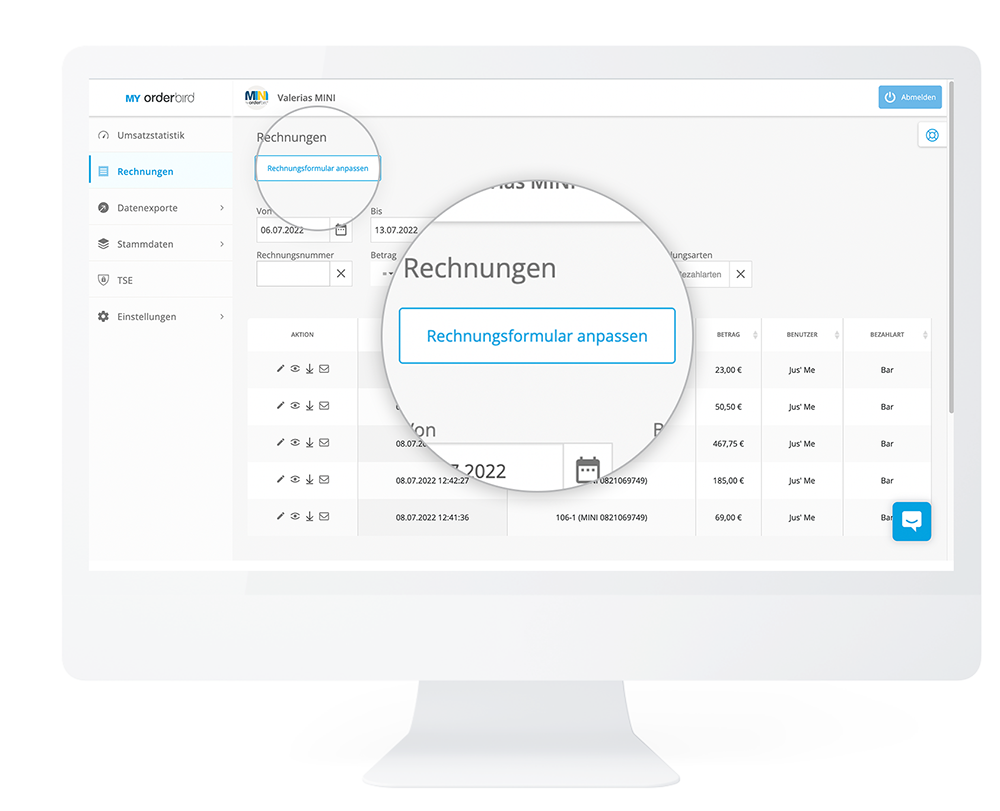

Customize billing settings for all bills

- Go to MY orderbird > [Receipts]

- At the top, click “Customize Invoice Form”.

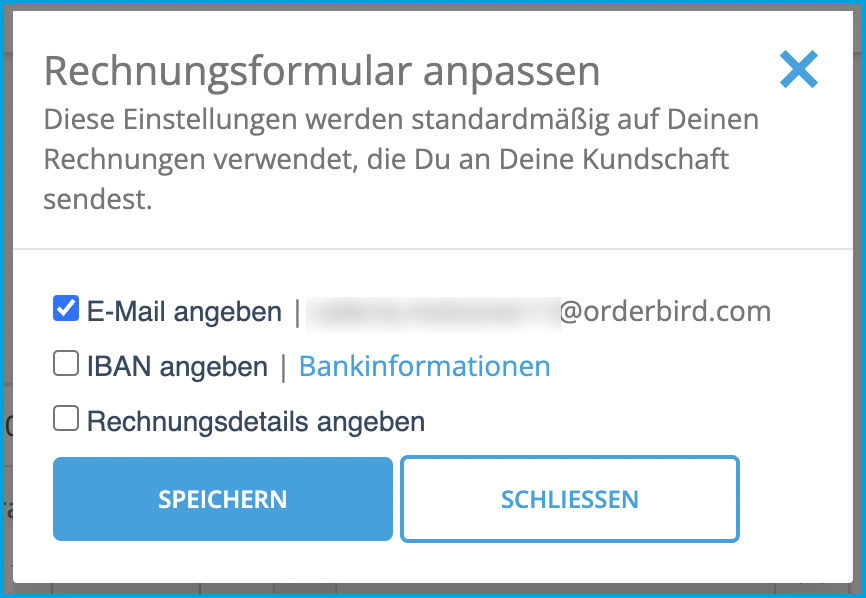

- Set whether your e-mail address, the IBAN or the billing details (formerly "entertainment receipt") should be visible on the bill to your customers.

- Done :) If you download the invoice now or send it to your customers by email, the corresponding settings will be applied. Also, retrospectively for old invoices!

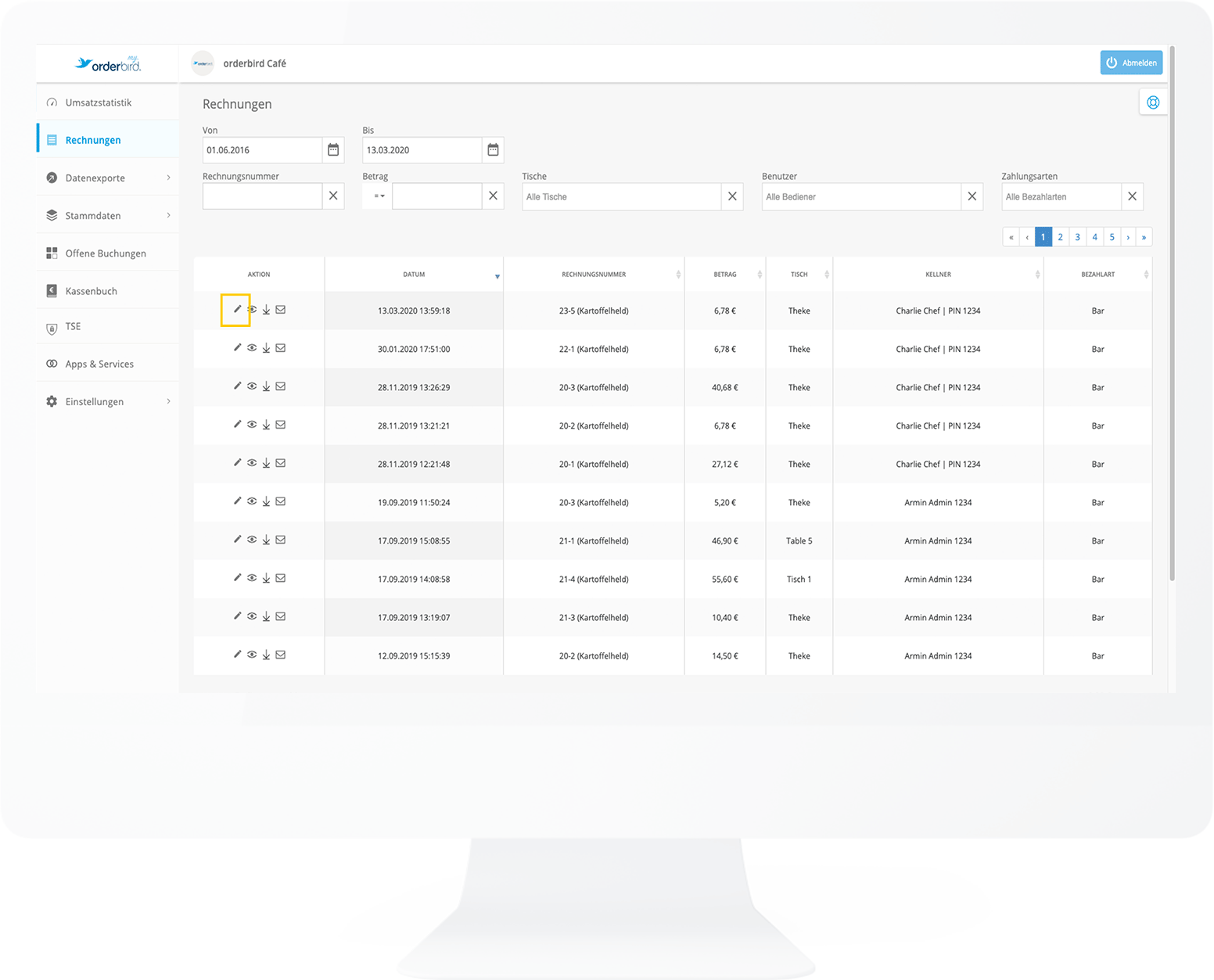

Customize billing settings for a single bill

- Go to MY orderbird > [Invoices]

- Click on the little pencil in front of an invoice to edit it.

- Now you can make various changes:

- Enter the address of the invoice recipient. Please note: If there is already recipient data here, and you change it, the old recipient data will be overwritten!

- Enter the performance date. Important: Stating the service date is mandatory by law if the invoice is to be tax-deductible. With us, the service date always corresponds to the invoice date.

- Enter a payment target, i.e. a date by when you should receive the money.

- Simply activate the checkmark for "Your bank information" so that your customers can see where the money should go. Then the customers will get the bank details stored in MY orderbird on the invoice!

- Enter your e-mail address so that your customer can contact you if they have any questions.

- Check the “Detailed Invoice” box to attach an “Entertainment Receipt” to the invoice.

- Download the invoice as a PDF and print it out or email it to your customer.

Tax office compliance

Every change that you make to an invoice is logged in your journal and is therefore traceable at any time and therefore compliant with the tax office.